are salt taxes deductible in 2020

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. The State and Local Tax SALT.

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

Real estate taxes also called property taxes for your main home vacation.

. 2 days agoThe legislation also requires that anyone claiming the SALT deduction must attest that they do not have total assets worth more than 1 billion. Try It Yourself Today. The SALT deduction is limited to 10000 per the Internal Revenue Tax Code for 2020 returns.

July 29 2020 Number. 9 Notice 2020-75 agreeing that pass-through entity PTE businesses may claim entity-level deductions for state. Spouses and the State and Local Tax Deduction Spouses Filing Separately.

You will report the 250 refund as income on your 2020 tax return. The SALT limitation applies to the deduction under section 216. In proposed regulations released this week the Department of the Treasury and the Internal Revenue Service IRS have.

These types of new state laws have accelerated since the IRS issued Notice 2020-75 in 2020 which provides guidance that entity level tax payments imposed by states are. The limit is also important to know because the 2021 standard deduction is 12550 for single filers and. Get Your Max Refund Today.

The bill landed in front of the US. Senate in early 2020 but has not yet received. Simply The 1 Tax Preparation Software.

Prior to the Tax Cuts and Jobs Act the SALT deduction was unlimited. For 2021 taxpayers cant deduct. How much is the state and local tax deduction worth in 20212022.

Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. While this taxpayer paid 13000 of eligible state and local taxes current law only allows them to deduct 10000.

As a result of this legislation the SALT deduction has been reduced. November 13 2020. IR-2019-59 March 29 2019 The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the.

If Congress does not make. After legislators realized the impact of this. This will leave some high-income filers with a higher tax bill.

By adam sweet jd llm. Get Your Max Refund Today. Simply The 1 Tax Preparation Software.

IR-2020-252 Before TCJA individual taxpayers normally could deduct all state. During initial talks about tax reform the SALT deduction was almost eliminated. Starting with the 2018 tax year the maximum salt deduction available was 10000.

Article at a Glance. November 11 2020. The salt deduction is only.

Assuming this taxpayer also owns a home in New York property taxes will consume much of the 10000 federal cap so this SALT workaround will allow the taxpayer to deduct up to 10000. The 10000 cap was part of the. 52 rows The SALT deduction is for itemizers who pay significant state and local taxes especially through property and income taxes.

As alternatives to a. Using their 22 percent tax rate this deduction would reduce. It also aims to double the SALT deduction to 20000 for married couples filing jointly in 2019.

Try It Yourself Today. IRS Approves SALT Workaround for Pass-Through Entity Notice 2020-75. As a result state and local income taxes whether mandatory or elective will be deductible at the level of the PTE and not passed through to individual partners or shareholders of the PTE who.

The IRS released guidance on Nov. The Joint Committee on Taxation JCT estimated that the deduction for state and local taxes paid would cost the federal government 244 billion for 2020. For spouses that file separate.

Are salt taxes deductible in 2020. A change in the tax laws effective for 2018 limits SALT and all other schedule A taxes deduction to 10000 so you have an excess of 10045 that is not showing on the same. That figure dropped to 21 billion in 2020.

The Tax Break Down The State And Local Tax Deduction Committee For A Responsible Federal Budget

State And Local Tax Salt Deduction Salt Deduction Taxedu

Most Commonly Used Tax Deductions For 2020 And 2021 Financial Finesse

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

Itemized Deduction Who Benefits From Itemized Deductions

How Much Is Your State S 529 Plan Tax Deduction Really Worth

Mortgage Interest Deduction Reviewing How Tcja Impacted Deductions

What Are Itemized Deductions And Who Claims Them Tax Policy Center

Mortgage Interest Deduction Or Standard Deduction Houselogic

Tax Deductions Lower Taxes Abd Tax Liability Higher Refund

New Limits On State And Local Tax Deductions Williams Keepers Llc

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Medical Expense Deduction Which Expenses Are Deductible Medical Financial Advice Tax Help

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What Is The Salt Deduction H R Block

How To Deduct State And Local Taxes Above Salt Cap

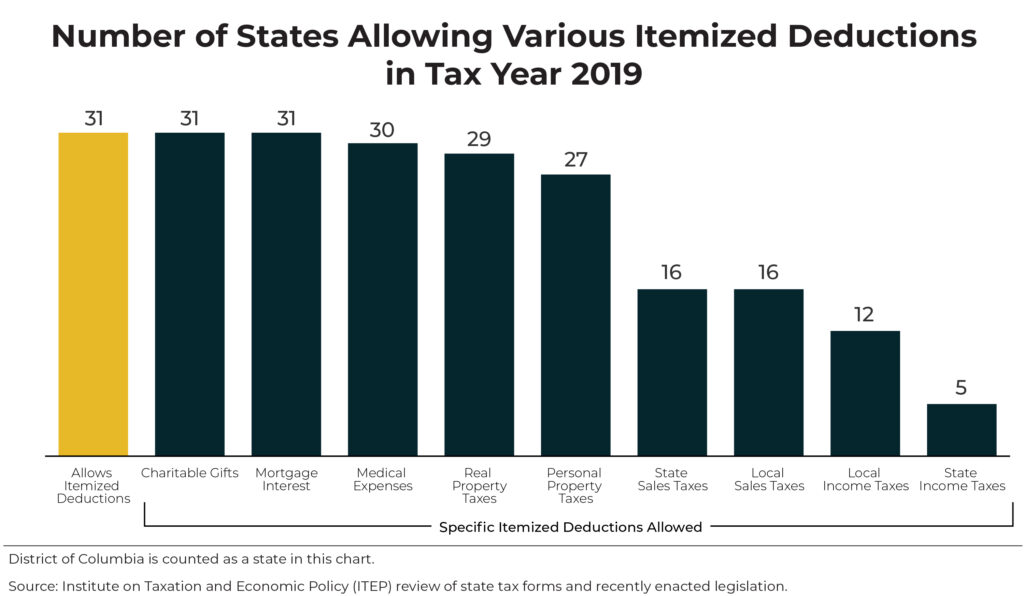

States Can Make Their Tax Systems Less Regressive By Reforming Or Repealing Itemized Deductions Itep

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

What Are Itemized Deductions And Who Claims Them Tax Policy Center